No. Housing economists and analysts agree that any market correction is likely to be modest — no one expects price drops on the scale of the declines experienced during the Great Recession.

The likelihood of a market crash is minimal.

— LAWRENCE YUN, CHIEF ECONOMIST, NATIONAL ASSOCIATION OF REALTORS

There are still far more buyers than sellers, and that means a meaningful price decline can’t happen: “There’s just generally not enough supply,” says Mark Fleming, chief economist at title insurer First American Financial Corporation. “There are more people than housing inventory. It’s Econ 101.”

Dave Liniger, the founder of real estate brokerage RE/MAX, says the sharp rise in mortgage rates skewed the market. Many would-be buyers had been waiting for rates to drop — but if rates decline significantly, it could send a rush of new buyers flooding into the market, pushing up home prices. “You’ve got an entire generation of pent-up demand,” Liniger says. “We’re in this fascinating position of tremendous demand and too little inventory. When interest rates do come down, it’ll be another boom-and-bust cycle.”

The numbers don’t represent a crash, but they do show a housing market coming back to earth.

related news & insights.

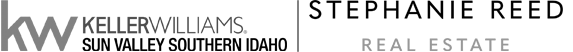

Weekly Update April 7 to April 13

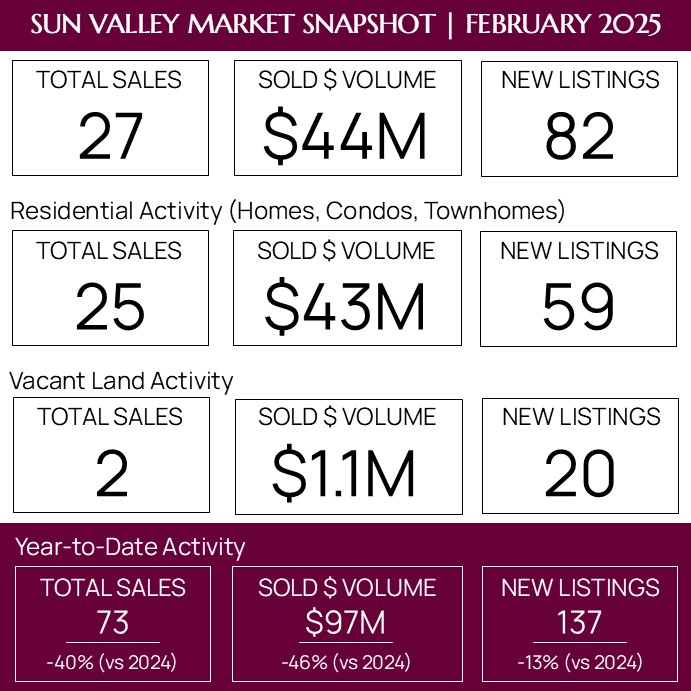

Last Week in Real Estate The market is moving steadily along, with 30 closings for over $67M in the last two weeks. And with 16 new listings joining the market last week, the inventory is starting to pick up. Baldy will be open one more week, Warm Springs side only, with the Baldy Bash happening Saturday [...]